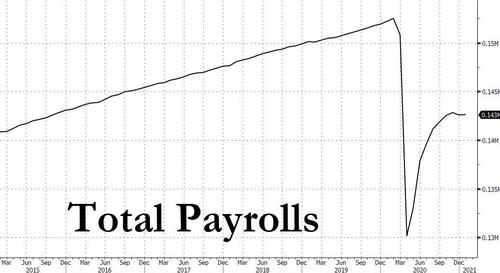

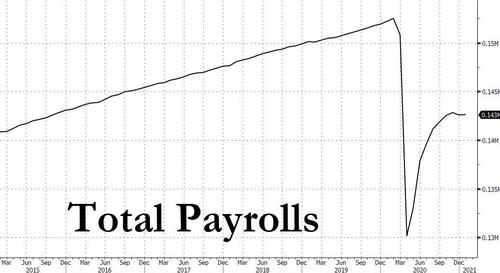

Some time in late 2020, a sellside analyst penned the term "K-shaped recovery" meant to describe a pandemic-stricken world in which while some 11 million people have (still) lost their jobs from the February high…

… others were making millions, and in some cases, billions.

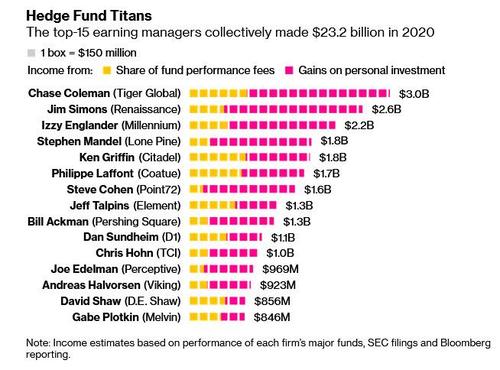

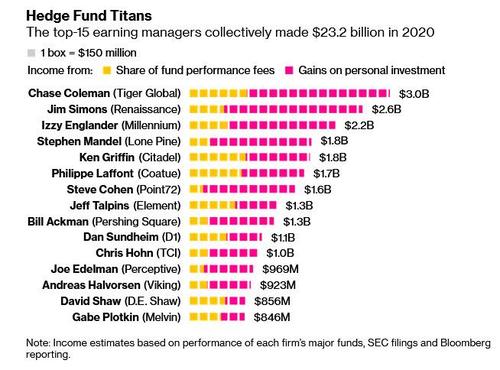

For better or worse, the "K-shaped recovery" term stuck and nowhere is it more applicable than in an article from Bloomberg today which shows that just the 15 top hedge fund managers on Wall Street raked in a combined $23 billion in 2020. Using the contextual parlance of our times, that’s "more than enough money, at going prices, to buy one GameStop, two AMC Entertainments and four Bed Bath & Beyonds. Not shares — those darlings of the r/wallstreetbets crowd -– but the entire companies."

And while the staggering sum would have been sufficient to make these 15 individuals into billionaires from what they earned last year alone, that’s a moot point since most of them were already billionaires.

As shown below, the biggest winner from the staggering market rally which soared from its March lows even as the broader economy sank, was Tiger Global’s Chase Coleman, who gained $3 billion personally in 2020. His fund returned 48% after building substantial stakes in Zoom, Peloton and JD.com, a portfolio almost perfectly positioned for the pandemic. And yes, Coleman was already a billionaire heading into 2020.

Coleman’s fund returned 48% last year, earning him substantial fees. The majority of his gains, though, were from his stake in the fund. One of Tiger Global’s most successful bets was on Sunrun Inc., turning a $340 million investment in the solar-energy company into $1.5 billion.

Other Tiger Cubs that traditionally favor tech stocks, such as Coatue Management, Viking Global and D1 Capital, also made Bloomberg’s list.

A new entrant to the list was Bill Ackman – who was also a billionaire heading into 2020 – who made $1.3 billion after shorting credit markets at the start of 2020 and then betting on the recovery following a tearful appearance on CNBC.

Amusingly, the last name on the list – Gabe Plotkin – has made the headlines in recent weeks after his hedge fund Melvin Capital lost 53% of its assets on the Reddit short squeeze. Then again, with $846 million in 2020 earnings alone, we are confident Gabe will be ok.

At the same time, several "usual suspects" were conspicuously absent, including Ray Dalio, whose Bridgewater had a forgettable 2020 as his Pure Alpha II fund lost money for a second straight year (following a catastrophic August when the fund was down 18.6%) and for just the second time in two decades. Quant fund Two Sigma, another perennial winner, also missed the cut as volatile markets largely favored human stock-pickers.

Other fund managers would have also made the list, but the Bloomberg ranking only includes those who continue to manage money for outside investors. That’s why Michael Platt, whose Bluecrest Capital Management returned 95% last year after it stopped managing outside money in 2015 (it since emerged that he was effectively frontrunning his outside clients), was excluded despite an estimated personal gain of $5 billion. Platt and others who manage money only for themselves face fewer restrictions than other asset managers, such as limits on leverage and risk.

The reason behind this unprecedented compensation is simple: their hedge funds generated staggering returns, with the lowest 2020 P&L at 14% for TCI and RenTec as usual leading the list with a whopping 76% return for its employees-only Medallion fund (its public facing funds had a much worse resulting in $5 billion in redemptions after a "terrible" year).

“CEOs at Fortune 500 companies can go for years with miserable performance and it doesn’t affect their compensation,” said Erik Gordon, a professor at the University of Michigan’s Ross School of Business. “But hedge fund compensation is more tightly related to performance.”

As Bloomberg notes, "that 15 people — all of them men — could earn so much so quickly starkly illustrates the widening rift between the ultra-rich and everyone else at a time of heightened unemployment and division over the scope of government response."

But as long as the peasants also got $600 "stimmies" all is well.

The historic gains by a handful of Wall Street tians demonstrates “the disconnect between the stock market and the real economy,” said finance professor Reena Aggarwal, director of Georgetown University’s Center for Financial Markets & Policy. While high volatility and low interest rates buoyed hedge funds, much of the population struggled “with worries about health, jobs, mortgage payments and student loans,” she said.

But that’s ok: as long as the government continues to provide guaranteed basic income "stimmies" of a few hundred bucks to the peasants to keep them placated, we doubt that anything will ever change and expect the gains for the "top 15" to be even bigger this year.

![]()