This Is Why Hospitals Can Charge $6,000 Or $60,000 For The Exact Same Procedure

Several months back, we pointed out how new disclosure laws would be forcing hospitals to disclose the cost of services and rates negotiated by insurers. Now, the numbers are starting to trickle in – and they’re ugly.

Roughly 6,000 hospitals across the nation are starting to reveal the rates they negotiate with insurers for a number of procedures. The figures show how widely prices vary for the same procedure depending on who is paying, as highlighted by a new Wall Street Journal report.

For example, the report found that a C-section can cost between $6,241 and $60.584 – all depending on which insurer covers it. Niall Brennan, chief executive of the Health Care Cost Institute said: “It is shining a light on the insanity of U.S. healthcare pricing. It’s at the center of the affordability crisis in American healthcare.”

The rates are a key driver of the massive healthcare costs in the U.S., some of the highest in the world. It was a Trump administration rule that shed light on the differences in procedure pricing – some of the widest gaps in pricing of any U.S. industry. Gerard Anderson, a healthcare economist at Johns Hopkins University, commented: “These price differentials are unique to the healthcare and hospital industry.”

The prices have a direct effect on consumers, as they push up premiums and deductibles. And, in a stunning revelation, "total U.S. expenditures on private health insurance have increased 50% in the past decade through 2019, according to federal figures," the Journal wrote.

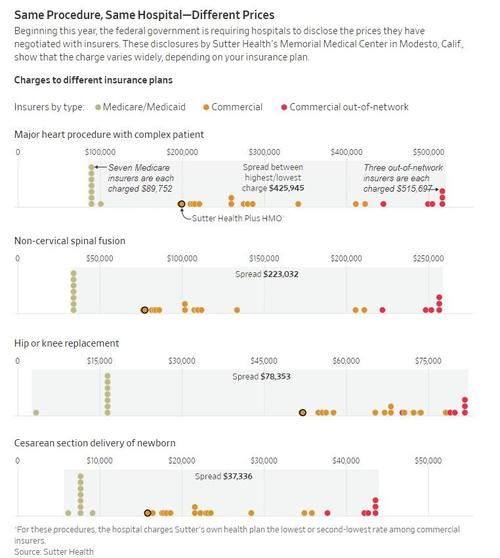

The report found that a Northern California system of 24 hospitals had sometimes "extreme" pricing ranges for procedures. One cardiac procedure varied between $89,752 to $515,697, depending on insurer. For those paying out of pocket, the procedure cost $325,703. The system, called Sutter Health, did $13 billion in 2019 revenue is is known for drawing an antitrust suit from the California state AG in 2018. The system paid $575 million to settle the claims.

Sutter Chief Financial Officer Brian Dean commented: “We enter into negotiations with every health-insurance company or payer in good faith and with the end goal of providing access to quality, affordable care for patients.”

“The variation in the data reflects robust competition in the markets for commercial insurance,” he argued.

One former insurance executive told the Journal that they could expect the same types of wide ranges for pricing across the country:

"The California system’s pricing spread for the procedures reviewed by the Journal are likely at the upper end, but similar patterns will be found at many hospitals around the country, said Alan Muney, a former Cigna Corp. executive. “This is probably typical of what you’re going to see across big delivery systems,” he said.

Prices paid by private insurers in the nation’s $1.2 trillion hospital sector are often far higher than the amounts paid to hospitals by the Medicare program, which are set by the government. Plans offered by insurers under Medicare or Medicaid often get rates tied to those mandated prices."

Insurers have a better chance of winning better rates if they can drive more patients to a certain hospital, another former insurance executive said. Hospitals, meanwhile, sometimes set their prices with "little bearing on the actual cost or value of a service", the report says. Rather, hospitals set prices based on their own targets for margins and according to what the market will pay.

Privately insured patients drive margins typically – and hospitals that boosted margins generally didn’t cut costs, but rather raised revenue by increasing rates billed to commercial insurers, one study found. Economists have found that quality is generally no better at more expensive hospitals. Michael Chernew, the Leonard D. Schaeffer Professor of Health Care Policy at Harvard Medical School, said: “We have not found evidence that price is a great signal for quality.”

The new data will draw the eyes of insurers and hospitals, moreso than consumers. Elizabeth Mitchell, chief executive of the Purchaser Business Group on Health, which represents major employers, said they will use the data to help choose which hospitals to use and how to negotiate with insurers.

The Journal examined one cardiac code for cardiac-valve procedures involving catheterization performed on patients with risk factors. It confirmed that the largest spreads on pricing were in procedures that cost the most:

Seven insurers pay the lowest negotiated rate, $89,752, for their Medicare plans. The lowest price for a commercial-insurance plan, the type offered to employers, is $197,900. At the top end, the charge is $515,697 for patients whose health plans don’t have the hospital in-network.

For hip- and knee replacements, Medicaid and Medicare plans paid the lowest prices at the Modesto hospital, $3,264 and $16,349, respectively. The lowest price paid by a commercial insurer totaled $51,895. The highest rate reached $81,617, again for patients whose insurance didn’t include the Modesto hospital in-network.

Recall, we first brought up President Trump’s plans to institute these transparency plans back in January.

The $1.2 trillion industry comprising some 6% of the country’s economy is now subjected to more transparency than it has seen in decades. The point of instituting the disclosures, according to the Trump administration, was the hope that good ol’ fashioned market dynamics will kick in, and help lower prices across the board.

Previously, hospital pricing was negotiated confidentially between hospitals and the employer groups and insurance companies that pay for care.

Many criticized this system for obscuring market rates and helping drive up the cost of health insurance premiums paid by employers and workers. Rising hospital prices accounted for about one-fifth of the nation’s health spending growth over the last 50 years.

Now, we will see first hand if a free and open market can help solve some of the industry’s problems. At least, until President Biden reverses the new rules.

Tyler Durden

Sat, 02/13/2021 – 17:00

via ZeroHedge News

Enjoy this article? Read the full version at the authors website: https://cms.zerohedge.com/